Allmand Law is Texas's largest consumer bankruptcy firm. Attorney Reed Allmand holds board certification in consumer bankruptcy from the Texas Board of Legal Specialization. The Dallas-based team has filed thousands of Chapter 7 and Chapter 13 cases over the past 20 years.

The firm helps clients stop creditor harassment, prevent foreclosures, and discharge medical debt. Services include credit repair guidance after filing. Spanish-speaking staff is available for consultations.

Allmand Law serves clients throughout the Dallas-Fort Worth area, including Arlington, Fort Worth, Plano, and San Antonio. Free financial empowerment sessions help clients understand their debt relief options before filing.

Latest Blog Posts

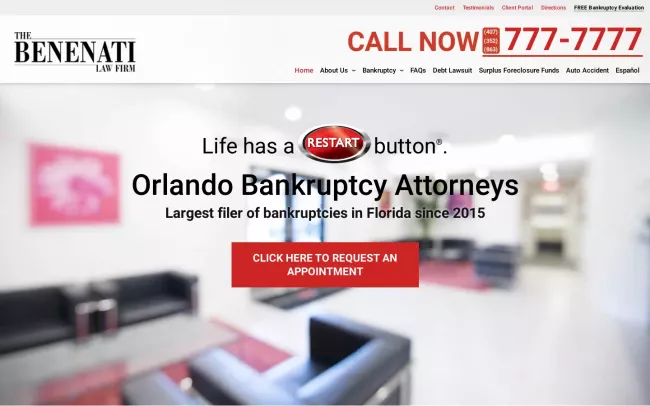

The Benenati Law Firm has been Florida's largest bankruptcy filer since 2015. Walter Benenati leads a team that handles Chapter 7, Chapter 13, and Chapter 11 cases for Orlando residents. He brings a personal perspective to debt relief—having filed bankruptcy himself before becoming an attorney.

The firm holds an Avvo 10.0 rating and AV Preeminent status from Martindale-Hubbell. Florida Legal Elite recognition and BBB accreditation reflect the team's dedication to client service. Payment plans and Saturday consultations make filing accessible for working families throughout Central Florida.

Latest Blog Posts

Howard and Robert Kent are a father-son bankruptcy team serving Atlanta families since the 1980s. Together, they bring over 40 years of combined experience in Chapter 7 and Chapter 13 filings. The firm is known for treating clients like family—many return for estate planning services years later.

Cases can be filed within 48 hours when clients have all the required documents. The team offers payment plans and keeps fees affordable. Seniors and military veterans receive special attention.

Located near the Lenox MARTA station, the office provides Saturday appointments for busy schedules.

Westgate Law is a Los Angeles bankruptcy attorney firm with over 7,000 cases filed. Attorney Justin Harelik runs offices in Paramount and Montebello, serving clients throughout LA County.

The firm takes a three-step approach: stop the immediate debt crisis, execute a plan, then rebuild credit. Many clients never file bankruptcy because the team negotiates settlements during the process. Google reviews average 4.9 stars across 289 ratings.

Transparent pricing sets Westgate apart. No hidden fees are added at the creditor meeting. Spanish-speaking staff and collection harassment defense round out their services.

Frego & Associates is Michigan's largest bankruptcy law firm. The team has filed over 40,000 cases and held that top ranking for more than 20 years. Five offices—Dearborn Heights, Detroit, Flint, Warren, and Saginaw—serve clients statewide.

Combined attorney experience exceeds a century. The firm handles Chapter 7, Chapter 13, and Chapter 11 filings along with foreclosure defense and discharge violation cases.

Free consultations include bankruptcy analysis and post-filing credit repair guidance. Most cases start at just $100 down.

Latest Blog Posts

Pete Moak is Arizona's most-reviewed bankruptcy attorney. He has practiced in the state since 1977 and helped over 1,000 clients eliminate debt. The Chandler office offers $0 down payment plans and 24/7 consultation availability.

Moak wrote "Life After Bankruptcy," sharing strategies for financial recovery. His BV rating from Martindale-Hubbell and media appearances on Bloomberg and the Arizona Republic reflect his standing in the field.

The firm handles Chapter 7 and Chapter 13 cases, debt settlement, and foreclosure alternatives.

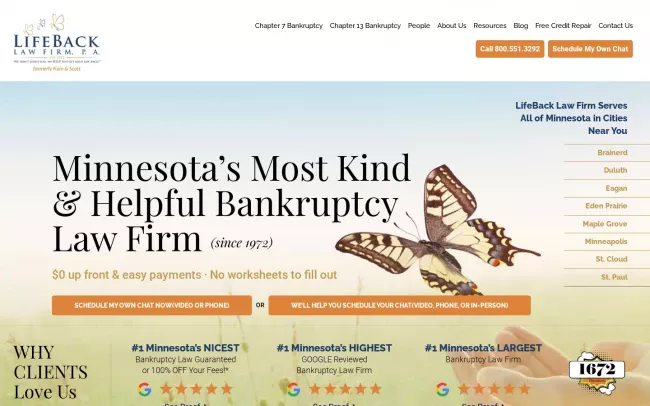

LifeBack Law Firm is a Minnesota bankruptcy practice with roots dating back to 1972. The firm operates seven offices—St. Cloud, Minneapolis, St. Paul, Duluth, Brainerd, Eagan, and Maple Grove—making debt relief accessible across the state.

What sets LifeBack apart is its post-filing support. Every client receives a free 90-day credit recovery program. The team also handles student loan forgiveness cases.

Chapter 7 and Chapter 13 filings help Minnesota residents stop wage garnishments, prevent foreclosures, and eliminate credit card debt.

The Rashid Law Firm has discharged over $100 million in debt for Houston-area clients. Since 2009, the team has handled more than 3,000 bankruptcy cases and 8,000 total legal proceedings.

Ranked among Houston's top bankruptcy firms for nine consecutive years. The same Gulf Freeway location has served clients for over 15 years.

Spanish-speaking staff assists bilingual families. Chapter 7 and Chapter 13 filings help stop foreclosures, lawsuits, and wage garnishments throughout Harris County and surrounding areas.

The Lane Law Firm focuses on Texas business bankruptcy and insurance disputes. The Houston team helps small business owners deal with predatory merchant cash advance lenders and SBA loan problems.

Beyond debt reorganization, attorneys fight denied property insurance claims and defend against foreclosure actions. Offices in Houston, Dallas, San Antonio, and Austin serve businesses statewide.

Chapter 7, Chapter 11, and Chapter 13 filings protect both business and personal assets from aggressive creditors.

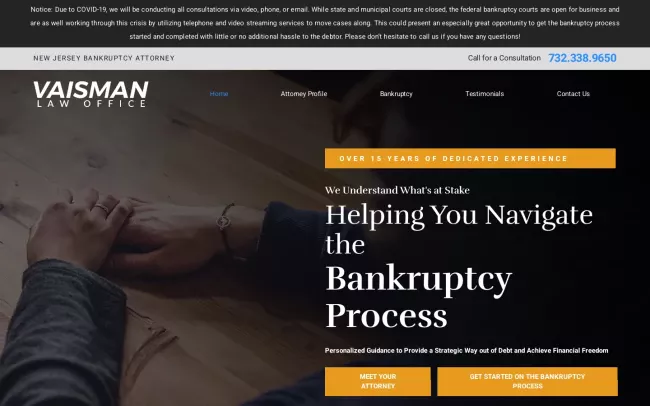

Edward Vaisman is a New Jersey debt relief attorney with over 15 years of bankruptcy experience. He appears in court at least twice weekly and personally knows every bankruptcy trustee in the state.

The Woodbridge Township office handles Chapter 7 and Chapter 13 filings along with creditor harassment defense, wage garnishment stops, and bank levy protection. Flexible payment options keep services accessible.

Hundreds of clients have found financial freedom through the firm's personalized approach to debt elimination.

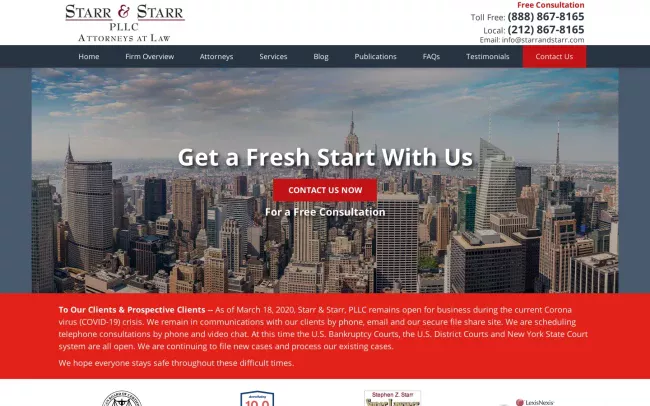

Starr & Starr is a Manhattan bankruptcy firm with board-certified specialists. The boutique practice handles personal and business filings for clients across all five NYC boroughs and New Jersey.

The team earned Avvo's 10-rating and Super Lawyers recognition. Their American Board of Certification credentials in business bankruptcy set them apart for complex cases.

Chapter 7 eliminates unsecured debts. Chapter 13 cures mortgage defaults. Chapter 11 helps entrepreneurs restructure under the Small Business Reorganization Act.

Wadhwani & Shanfeld are California bankruptcy specialists with over 25,000 satisfied clients. Both founding partners—Raj Wadhwani and Greg Shanfeld—hold American Board of Certification credentials.

Raj pioneered electronic bankruptcy filing in California's Central District. Greg brings 30 years of hands-on experience. Together, they have filed over 25,000 cases.

Six Southern California offices—Long Beach, Los Angeles, Sherman Oaks, Lancaster, Ontario, and Palmdale—make debt relief accessible. A+ BBB rating reflects consistent client satisfaction.

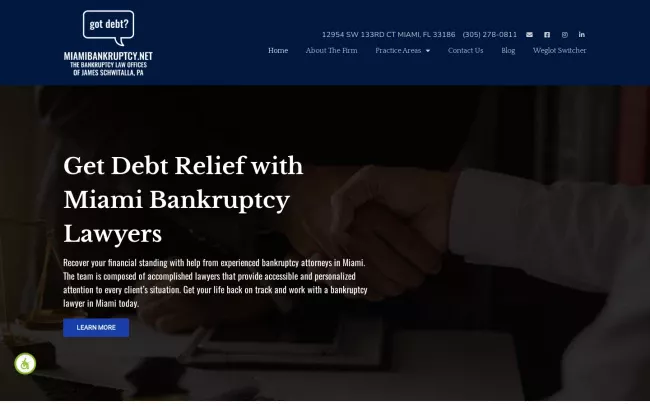

James Schwitalla is a Miami bankruptcy attorney with over 30 years of courtroom experience. He has argued cases before the U.S. District Court, the 11th Circuit Court of Appeals, and the U.S. Supreme Court.

Super Lawyers has recognized Schwitalla every year from 2019 to 2025. His Kendall office serves Miami-Dade County, South Florida, and the Florida Keys. Spanish-speaking attorneys assist bilingual families.

The firm handles Chapter 7, Chapter 13, and complex bankruptcy litigation.

Latest Blog Posts

Former U.S. Bankruptcy Judge Kathleen March leads The Bankruptcy Law Firm. She served 14 years on the bench before returning to private practice. Her 35 years of total experience includes authoring the Rutter Group California Bankruptcy Practice Guide.

March holds triple certification as a bankruptcy specialist—consumer, business, and through the American Board of Certification.

The Los Angeles firm represents both debtors and creditors in Chapter 7, Chapter 13, and Subchapter V cases throughout Southern California.

Talkov Law handles California bankruptcy alongside co-ownership disputes and partition actions. Scott Talkov earned Super Lawyers recognition for his real estate and debt relief work.

The firm operates eight offices: Los Angeles, Orange County, San Francisco, San Jose, San Diego, Riverside, Sacramento, and Redding. Creative solutions help clients when other attorneys say no options remain.

Chapter 7, Chapter 11, and Chapter 13 filings serve individuals, families, and small businesses.

Latest Blog Posts

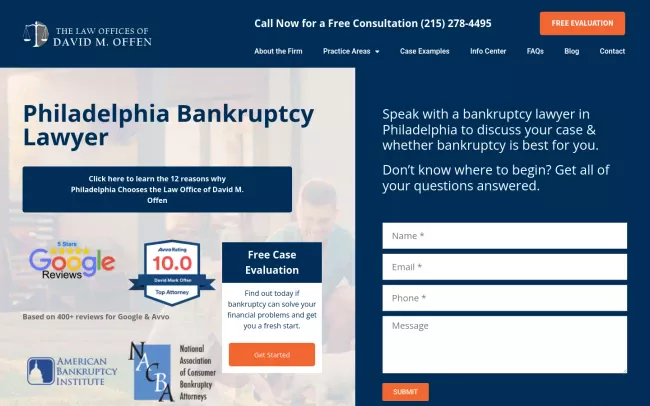

David Offen has filed over 12,000 bankruptcy cases in Philadelphia since 1995. His firm has discharged more than $200 million in client debt and saved thousands of homes from foreclosure.

Over 400 five-star reviews span Google and Avvo. The firm holds Avvo's 10.0 superb rating and BBB A+ accreditation.

Zero-down payment plans and evening appointments make Chapter 7 and Chapter 13 filings accessible for working families throughout Eastern Pennsylvania.

Relief Lawyers is a Las Vegas firm handling business litigation, real estate disputes, and debt-related cases. The team has resolved Nevada property matters since 2001. Personal injury cases proceed on contingency—no fee unless they win.

Latest Blog Posts

Jon Brooks is a Bay Area debt relief attorney who has filed over 1,000 bankruptcy cases since 2004. The firm treats every client with dignity while fighting aggressive creditors. Free consultations help San Jose families explore their options.