Demian & Company, LLC provides tax preparation, bookkeeping, and payroll services for individuals and businesses throughout Elizabeth, Cranford, and East Brunswick, NJ. This certified public accounting firm has served clients for over 23 years. Licensed CPAs help with IRS settlement, estate planning, and wealth management across 49 states. QuickBooks-certified accountants handle entity selection and litigation support. The boutique practice maintains high client retention through personalized service. New clients receive special discount offers on tax preparation.

Filo Mortgage offers low mortgage rates with zero lender fees. The Conshohocken, PA, company closes loans in 3 weeks using digital technology. They've funded over $6 billion since 2019. Licensed in 28 states, Filo provides conventional, FHA, VA, and jumbo loans. Their A+ BBB rating reflects hundreds of 5-star reviews. The platform offers 24/7 support and transparent pricing. They pre-negotiate third-party fees to save borrowers money.

MarketWatch delivers real-time financial news and stock market data. Owned by Dow Jones & Company, the New York site launched in 1997. You'll find market analysis, investment insights, and personal finance advice. The platform tracks index movements, stock prices, and key securities. MarketWatch operates alongside The Wall Street Journal and Barron's. The site now offers subscription-based premium content.

Entrepreneur provides news and advice for business owners. The media company publishes articles on starting companies, raising money, and growing sales. You'll find interviews with successful founders and tips from industry experts. Topics cover marketing, leadership, technology, and franchising. Entrepreneur also produces podcasts, videos, and events. The magazine has served the business community for over 40 years.

Seeking Alpha is a New York investment research platform serving millions of investors since 2005. The site provides stock analysis, market insights, and quant ratings. Thousands of analysts contribute research on stocks, ETFs, dividends, and market trends. Seeking Alpha covers all asset classes and publishes timely investment ideas. The platform connects professional investors with individual investors who share market insights.

The Penny Hoarder helps Americans earn, save, and manage money. Founded in 2010 by Kyle Taylor, the St. Petersburg site reaches millions monthly. Inc 5000 named it one of America's fastest-growing media companies for three straight years. Clearlink acquired the platform in 2020. You'll find practical advice on side hustles, budgeting, and cutting expenses. The site focuses on readers with lower incomes.

Council Tax Advisors helps UK residents resolve council tax problems and deal with enforcement officers. The company has assisted over 50,000 people with council tax disputes, billing issues, and bailiff matters.

Services include council tax liability reviews, valuation appeals, discount applications, and repayment plan negotiations. The team also handles disabled-reduction claims and empty-dwelling cases.

Council Tax Advisors operates as a trading style of Help With Debt Ltd. The company has been featured in LocalGov, BBC, and The Express. Free debt advice is available through Money Helper, the government-backed service.

Latest Blog Posts

Finance Me is a Sydney-based mortgage broker serving clients across Australia. The company holds an Australian Credit License 386838. They specialize in complex lending situations that major banks often decline.

The team handles bad credit home loans, alt-doc loans for self-employed borrowers, and SMSF property financing. They also offer expat home loans, near-prime options, and commercial property lending up to $15 million. Finance Me works with clients in Sydney, Melbourne, Brisbane, Perth, and other major Australian cities.

Latest Blog Posts

Workers Compensation Shop.com connects employers with workers' comp insurance nationwide. The agency holds licenses in all 50 states and works with over 50 insurance carriers. They help businesses compare quotes and find coverage for hard-to-place class codes. Founded in 2004, the company offers Pay As You Go programs that align premium payments with actual payroll. Their team reviews job classifications to prevent audit issues. Services include coverage for new businesses, high-risk industries, and companies with elevated experience modification rates.

Burial Insurance Pro compares final expense quotes from AIG, Fidelity Life, Gerber, and other top providers nationwide. They help families save up to 58% on burial insurance without medical exams. Most policies activate within one business day. The service matches clients with plans offering coverage from $2,000 to $100,000. Free evaluations determine the best rates for individual needs. Their platform simplifies comparing policies to protect families from funeral costs and outstanding debts.

Latest Blog Posts

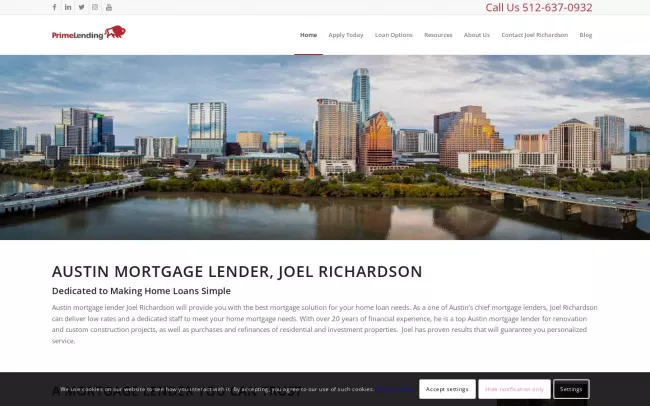

Joel Richardson is an Austin mortgage lender with over 20 years of experience in home financing. He holds an MBA in Finance and ranks among the top 1% of loan originators nationwide. His team serves homebuyers throughout Texas and across the country.

Loan options include conventional mortgages, FHA, VA, jumbo, and construction loans. The team also handles condo financing, cash-out refinances, and home renovation loans. Joel specializes in owelty liens for divorce situations and investment property financing. Austin Monthly Magazine named him a Top Mortgage Professional in 2023 and 2024.

Latest Blog Posts

Goodwin Investment Advisory has served Canton, GA, families with fee-only financial planning since 2004. The CFP professional team manages investments for clients with $300,000+ portfolios. They earned Dave Ramsey SmartVestor Pro endorsement and 5-star client reviews. Tim Goodwin founded the fiduciary firm in Woodstock, GA. Services include retirement planning, tax strategies, and estate planning. Advisors invest their personal money in the same way as client funds.

Latest Blog Posts

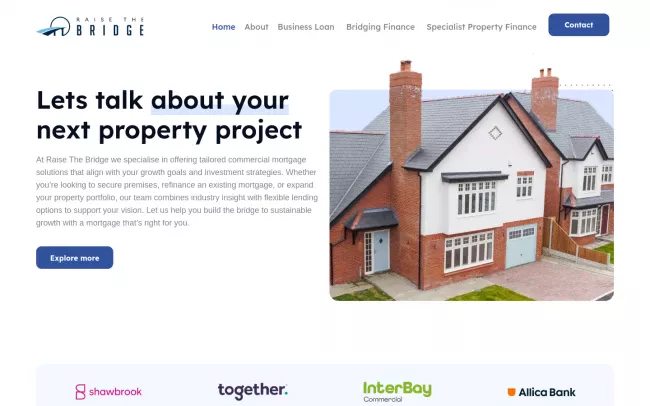

Raise The Bridge is a commercial finance broker based in Liverpool, Merseyside. The FCA-authorized firm specializes in commercial mortgages, bridging finance, and business funding solutions. Their team provides whole-of-market advice for property development finance and asset funding. Businesses access competitive commercial loans through independent broker guidance.

Lewis CPA has provided full-service accounting and tax solutions to Chicago-area businesses and individuals since 1986. The firm handles income tax preparation, tax planning, bookkeeping, payroll, audits, estate and trust tax, and IRS representation. Founded by Susan S. Lewis, the practice serves over 1,000 businesses and 3,000 individual clients nationwide. Services include mergers and acquisitions support, state and local tax guidance, and financial planning. The team works with franchises, not-for-profits, healthcare providers, and real estate companies throughout Illinois.