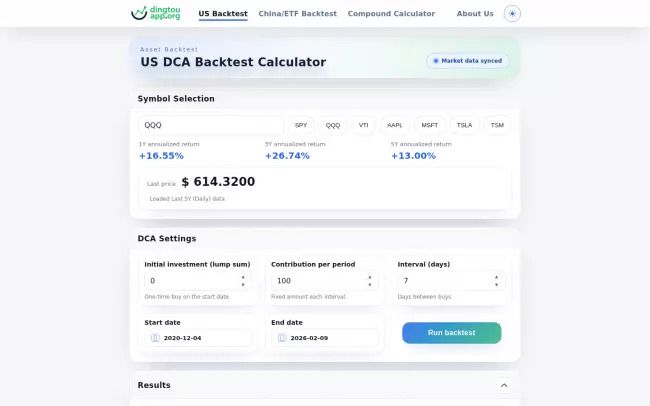

US DCA Backtest Calculator

About

US DCA Backtest Calculator lets you simulate dollar-cost averaging (DCA) and compounding growth using historical US stock and ETF data. It provides an accessible, risk-free way to evaluate long-term investment strategies by showing how regular contributions could have grown over time with real price history. By pulling historical prices and applying common DCA rules, the tool reveals potential outcomes under different schedules, frequencies, and starting points.

Key features include:

Backtests DCA and compounding using historical US stock and ETF price data, enabling realistic, data-driven scenarios without real-money risk.

Ticker-based simulations: Enter any ticker and customize your periodic investment amount, frequency, and start date to generate tailored results.

Clear visualizations: Interactive charts display growth trajectories, compounding effects, drawdowns, and key performance metrics for easy interpretation.

Strategy comparison: Quick side-by-side exploration of different contribution levels and schedules to see which approach performs best over time.

By combining real historical data with straightforward inputs and intuitive visuals, US DCA Backtest Calculator helps you understand the impact of DCA and compounding on your wealth and supports more informed, data-driven investment decisions.

Company Details

Reviews

Be the first to write a review