Nerd Wallet Blog is a personal finance resource that grew from an $800 startup to a publicly traded company. Founded in 2009 by Tim Chen after he spent a week researching credit cards for his sister, the San Francisco-based site now reaches over 20 million readers each month.

The platform compares credit cards, bank accounts, mortgages, and insurance products with side-by-side tools. A team of 80+ editors reviews every recommendation. Free credit score tracking lets users monitor their financial health without hidden fees.

NerdWallet stands out for its unbiased product comparisons and data-driven calculators. The blog covers investing basics, retirement planning, and tax strategies in plain English.

Andrew Schrage launched Money Crashers in 2008 after watching friends struggle during the financial crisis. A Brown University economics grad and former hedge fund analyst, he built the site to teach everyday Americans what schools never did about money.

The blog covers budgeting, credit card strategies, and real estate investing. Articles break down complex topics like 401(k) rollovers and tax deductions into easy steps. Money Crashers reaches millions of readers who want practical tips instead of Wall Street jargon.

Co-founder Gyutae Park handles the tech side. Their tagline says it best: "Turn the Tables on Money."

Pete Adeney retired at 30 with about $600,000 in savings. In 2011, he started Mr. Money Mustache to share how he and his wife escaped the 9-to-5 grind while their peers stayed stuck in debt.

The blog sparked the FIRE movement (Financial Independence, Retire Early). Over 23 million readers have discovered Pete's approach to aggressive saving, smart spending, and anti-consumerism. His writing style mixes humor with math-backed advice.

Posts cover everything from the 4% withdrawal rule to why biking beats driving. Fans call themselves "Mustachians" and organize meetups worldwide. The blog proves you don't need a six-figure salary to build real wealth.

MintLife Blog started in 2007 as part of Mint.com, one of the first apps to let users track all their accounts in one place. Intuit acquired Mint in 2009 for $170 million.

In 2024, Mint transitioned to Credit Karma. The blog now lives on as part of Intuit's financial wellness platform. Articles cover budgeting basics, spending habits, and credit score tips.

The content works well for beginners who want simple guides to everyday money questions. Credit Karma added features like net worth tracking and transaction history for former Mint users.

Crystal Paine started Money Saving Mom in 2007 while her husband was in law school. She fed her family on $30-35 per week and turned her extreme couponing skills into a blog that now reaches 1.5 million readers monthly.

A homeschool mom of six and New York Times bestselling author, Crystal shares grocery deals, meal planning ideas, and budgeting tips for busy families. The site helps readers stretch every dollar without sacrificing quality of life.

Latest Blog Posts

Sam Dogen worked at Goldman Sachs and Credit Suisse before retiring at 34 in 2012. He started Financial Samurai in 2009 after the market crash wiped out 35% of his net worth.

The blog mixes personal stories with data-driven analysis on real estate investing, stock strategies, and building passive income. Over 100 million readers have visited since launch. Dogen writes from firsthand experience, sharing actual numbers from his own portfolio and rental properties.

Latest Blog Posts

J.D. Roth had $35,000 in consumer debt on a $50,000 salary when he started Get Rich Slowly in 2006. By December 2007, he was completely debt-free.

The blog documents his journey from financial mess to early retirement. Roth has no formal finance background—just hard lessons learned through mistakes. That "regular guy" perspective resonates with readers who feel overwhelmed by money advice from experts. Articles focus on debt payoff strategies, saving habits, and building wealth step by step.

Saeed Darabi came to the US as a teenager from Iran in 2002 and built MoneyPantry from scratch in 2013. The blog has reached over 63 million readers searching for side hustles and money-making ideas.

Posts cover work-from-home jobs, freelance gigs, and legitimate ways to earn extra cash online. Darabi personally tests every opportunity before recommending it. The no-fluff approach helps readers avoid scams and find real income streams.

Latest Blog Posts

Steve Chou started an online store selling wedding handkerchiefs in 2007 when his wife got pregnant. That side business grew into a seven-figure ecommerce company and inspired the blog My Wife Quit Her Job.

A Wall Street Journal bestselling author, Steve teaches readers how to build profitable online businesses while keeping their day jobs. The blog covers Amazon FBA, ecommerce strategies, and creating passive income without sacrificing family time.

Latest Blog Posts

Nick Maggiulli writes one blog post every week at Of Dollars And Data, blending charts and research with clear money advice. A Stanford economics grad and COO at Ritholtz Wealth Management, he published "Just Keep Buying" which sold over 100,000 copies.

The blog uses data to answer questions like when to save vs. invest and how much house you can actually afford. Posts cut through financial myths with hard numbers.

Latest Blog Posts

Steve Adcock saved 70% of his income during a 14-year IT career and retired at 35 in 2016. Think Save Retire shares his blueprint for early retirement and now features multiple authors covering FIRE strategies.

The Adcocks live off-grid in an 800-square-foot desert house they bought with cash. Articles focus on aggressive saving, minimalism, and designing a life you actually want.

Kelan and Brittany Kline started The Savvy Couple in 2016 while drowning in $40,000 of student loan debt. He was a jail deputy; she was a fourth-grade teacher. Both quit their jobs by age 28.

Featured in Forbes and TIME, the blog has helped over 6 million readers with budgeting, side hustles, and making money online.

Latest Blog Posts

Money Done Right breaks down credit card rewards, banking bonuses, and smart money moves. The blog helps readers maximize cashback, travel points, and sign-up offers without the usual finance jargon.

Latest Blog Posts

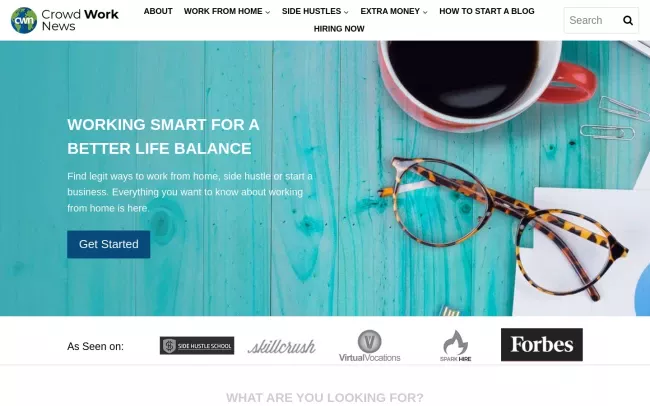

Sireesha Narumanchi founded Crowdworknews in 2016 after 11+ years working remotely. The blog helps job seekers find legitimate work-from-home positions and avoid scams.

Posts cover transcription jobs, freelance gigs, and remote career paths for people without traditional degrees.

Latest Blog Posts

Travel & Invest combines wanderlust with wealth-building. The blog covers dividend investing, travel hacking, and building income streams that fund adventures around the world.

Latest Blog Posts

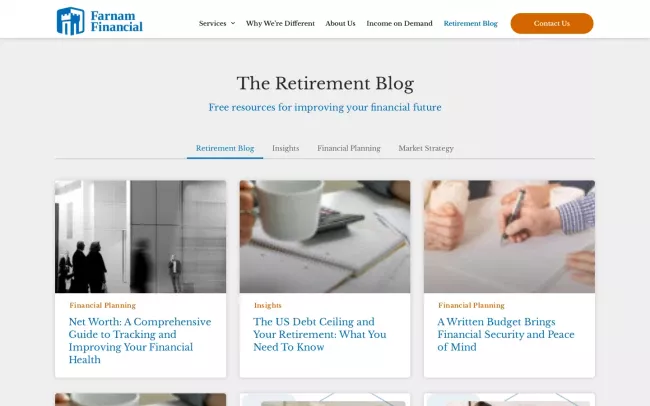

Farnam Financial's retirement blog offers practical guides on Social Security timing, 401(k) withdrawals, and building retirement income. Content targets pre-retirees planning their next chapter.